Trust online isn’t a rational equation; it’s a story we tell ourselves to avoid conflict. We see a watch we want, we see a seller with photos and a backstory, and our mind builds the rest from memory and hope. Ask any collector who’s been burned, and they’ll tell you the same thing: it never feels fraudulent in the moment. The human brain is adept at constructing patterns from partial data; it fills in missing evidence with plausible beliefs. Scammers exploit that by supplying the right breadcrumbs — a receipt, a blurred service invoice, a casual aside about a grandfather who served in the RAF — tiny details that make the fantasy feel true. They don’t need to forge everything; they need to make the lie plausible. And plausibility is all they need because once you’ve invested emotionally, confirmation bias does the rest. You want the watch to be real; therefore, you start to interpret every ambiguous signal as proof rather than a warning.

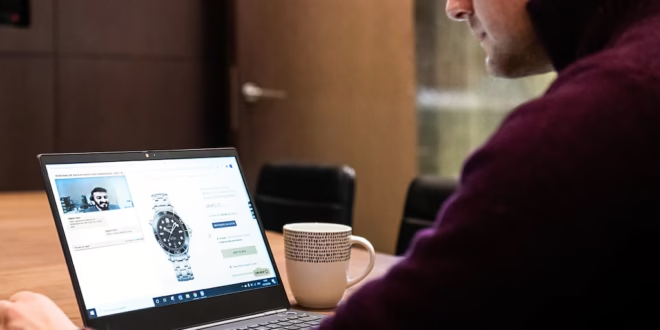

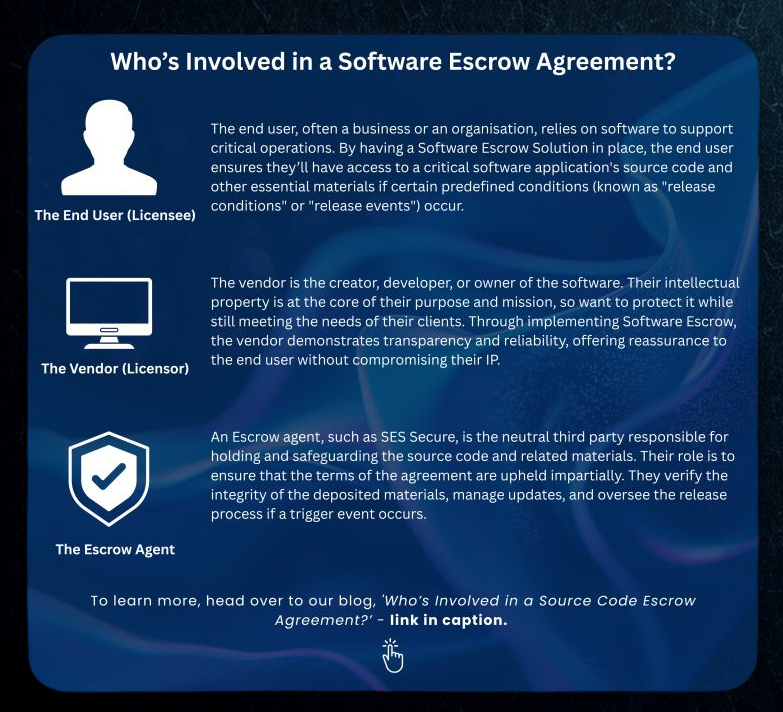

Platforms promise to be the guardian angels of commerce. eBay brandishes buyer protection like a shield; Chrono24 promotes verification and escrow; curated outfits like Watchfinder and WatchBox sell trust in a box with premium shipping and polished returns policies. But each of these systems has its Achilles’ heel. Verification badges and positive feedback are a lagging indicator: they prove you were trustworthy in the past, not that you can’t be dishonest tomorrow. Most professional scams are built on the “long con” model — small, genuine sales designed to build a spotless record, then a high-stakes strike. A Top-Rated eBay seller who has shipped dozens of cheap watches without incident can suddenly list a grail at a price that looks believable to the fatigued eye. By the time the complaint process rolls through, the account has moved on, or the seller has exploited procedural loopholes.

Escrow services reduce risk, but they can’t fix a fake that will pass visual inspection. If the watch is a Franken or a Superfake assembled from authentic donor parts and near-perfect clones, consensus among amateurs won’t suffice. Escrow buys you time, not certainty.

Facebook Marketplace and Instagram DM deals are a different beast entirely — the open-air market of the 21st century. They capitalise on the illusion of community: mutual friends, shared groups, likes and mutual followers. We assume proximity equals honesty. It rarely does. Here, the psychology flips from trust to urgency: “I’ve had interest already,” “I can hold until tomorrow,” “First deposit secures it.” The scam plays on the fear of missing out and the social desire to be first. The interface encourages rapid, informal transactions and often discourages the kind of slow, forensic interrogation a high-value sale demands. Scammers mirror this behaviour: they’re quick, polite and apologetic for any delay; they offer stories that humanise them; they pressure gently and then vanish. Frequently, they’ll suggest “friends and family” PayPal transfers, cryptocurrency, or bank transfers — channels that are harder to recover than card payments or platform-mediated escrow. The advice “buy the seller” becomes dangerous when the seller is a practised actor whose role is to be bought.

Counterfeits and Frankenwatches have also evolved. Where once counterfeit dials and cheap cases were obvious to the trained eye, we now face Superfakes — pieces that sit on the border between copy and forgery, built with cloned movements, high-end finishing and authentic-looking serial numbers. Frankenwatches are a different, but often just as pernicious, hazard: original parts cannibalised to build a watch that presents as a rare variant but in truth is a Frankenstein history stitched together from donors and aftermarket parts. The result is that a watch can feel right in the hand and still be a fake in spirit; it can tick and swing and shine and yet not be the watch the papers claim it is. Authentication has become forensic. It demands provenance, not just surface inspection. That, in turn, demands cooperation from brand service centres, documentation trails, and sometimes educated sleuthing through serial registries and service records. Not all brands help; many refuse authentications for pieces not sold through their network for liability reasons. So, you’re often left holding a case that requires expert attention you didn’t budget for.

Even worse is the fact that Facebook Marketplace and Instagram DM deals are a different beast entirely — the open-air market of the 21st century. They capitalise on the illusion of community: mutual friends, shared groups, likes and mutual followers. We assume proximity equals honesty. It rarely does. Here, the psychology flips from trust to urgency: “I’ve had interest already,” “I can hold until tomorrow,” “First deposit secures it.” The scam plays on the fear of missing out and the social desire to be first. The interface encourages rapid, informal transactions and often discourages the kind of slow, forensic interrogation a high-value sale demands. Scammers mirror this behaviour: they’re quick, polite and apologetic for any delay; they offer stories that humanise them; they pressure gently and then vanish. Frequently, they’ll suggest “friends and family” PayPal transfers, cryptocurrency, or bank transfers — channels that are harder to recover than card payments or platform-mediated escrow. The advice “buy the seller” becomes dangerous when the seller is a practised actor whose role is to be bought.

Counterfeits and Frankenwatches have also evolved. Where once counterfeit dials and cheap cases were obvious to the trained eye, we now face Superfakes or “Superclones” as seems to be the vogue term — pieces that sit on the border between copy and forgery, built with cloned movements, high-end finishing and authentic-looking serial numbers. Frankenwatches are a different, but often just as pernicious, hazard: original parts cannibalised to build a watch that presents as a rare variant but in truth is a Frankenstein history stitched together from donors and aftermarket parts. The result is that a watch can feel right in the hand and still be a fake in spirit; it can tick and swing and shine and yet not be the watch the papers claim it is. Authentication has become forensic. It demands provenance, not just surface inspection. That, in turn, demands cooperation from brand service centres, documentation trails, and sometimes educated sleuthing through serial registries and service records. Not all brands help; many refuse authentications for pieces not sold through their network for liability reasons. So, you’re often left holding a case that requires expert attention you didn’t budget for.

Shipping has become a core battleground. If you are selling, pack the watch like it’s an artefact rather than a parcel; photograph every stage, timestamped video recording, even better. Make use of props such as dated printed newspapers. If you are buying, insist on insured, signed-for shipping with a chain of custody and documentary proof of collection. Courier theft and fraudulent “signed for” claims are not urban myths. Parcels marked “delivered” but never received are a recurring nightmare. Some thieves hack the postal process; others intercept packages at sorting hubs using inside knowledge. That’s why the choreography of shipping matters: recorded video of the packing, photographs of serial numbers, recorded handoffs, insured transit and a confirmed signature at delivery. Even then, disputes will arise. PayPal and many banks are protective of buyers, and that can be weaponised against sellers with retrospective claims. Sellers must balance the risk of shipping against the imperative to close a sale. Ensure everything to fully declared. Use tracked, reputable couriers. If the buyer requests unusual delivery instructions, be suspicious.

Legal jurisdiction matters more than we like to acknowledge. Cross-border purchases complicate recourse: different consumer protections, customs delays that provide cover for scams, and legal costs that make chasing fraud economically impractical. If something is worth several thousand pounds, the only truly safe transaction is usually within your legal jurisdiction. Small claims courts can be effective, but they demand time and persistence. Judges are human and often sympathetic to clear evidence — bank transfers, chat logs, time-stamped photos — but litigation is time-consuming and emotionally draining. The most pragmatic approach for many of us is to keep transactions local whenever possible. Meet in person in safe public spaces; bring a friend; avoid taking unnecessary leaps of faith for the sake of a bargain.

The “buy the seller” doctrine is well-intentioned but insufficient in the modern climate. Have you ever heard of an honest liar? A polished seller’s profile is a tactic, not a guarantee. Con artists study the discourse of collectors: reference numbers, lug-to-lug measurements, dial variants, patina vocabulary. They mirror your language to lull you into complacency. That’s mirroring in behavioural terms — a technique long used by salespeople and diplomats — but online it becomes a cloak. The most dangerous fraudsters will roleplay as collectors for months, participating in groups, building rapport, sharing opinions, until the trust is total. When the strike comes, it’s not a transaction; it’s betrayal. This is why rigorous documentation matters. Demand timestamped photos with a live, unique item: the watch next to today’s newspaper, or the seller holding a piece of paper with the watch’s reference and the current date. Request videos of the running seconds hand, the crown being wound, and the serial number visible. If a seller hesitates, be suspicious. Genuine sellers are usually relieved by these checks; fraudsters are not.

Payment choices are another treacherous terrain. PayPal is popular, but the “friends and family” option is a minefield when used outside close personal relationships: it removes buyer protection and makes chargebacks difficult. Bank transfers are fast and final but almost impossible to reverse once completed. Credit card payments have greater consumer protections but often involve fees and need to be accepted by the seller. Escrow services add a layer of safety, at a cost, but they are only as robust as their procedures and the willingness of the buyer and seller to follow them. In high-value transactions, the friction of using an escrow is a small price to pay for peace of mind. Treat “I’ll do a bank transfer” as a red flag unless you know the person and have their verified identity on record.

Influencers and social media create new vectors of risk. The aspirational economy has monetised desire. When an influencer posts a brand-new Daytona with a caption about working hard for that moment, followers see a template for attainment. The resale market responds by inflating perceived demand, and speculators step in. Scammers mirror this dynamic by fabricating scarcity, posting staged photos, and creating the sense that a watch is fleeting — therefore, buy now, or lose it forever. Then there is influencer complicity: paid endorsements that blur into shilling, clickbait that leads followers into dubious auctions, or “dealer accounts” bolstered by promoted posts that hide shady provenance. The modern collector must separate curation from commerce. A glossy feed does not imply ethics.

Grey markets deserve a separate interrogation because they occupy a morally ambiguous middle ground. Some grey dealers are legitimate: they purchase surplus and unsold stock and pass savings to buyers. Others exist in a twilight of opportunism: discounts that come at the expense of warranty, incomplete paperwork, or opaque origins. The risk here isn’t always that the watch is fake; it’s often that the protective scaffolding of authorised retail — warranty, service history, manufacturer support — comes with conditions absent in grey channels. If a watch needs service, an unauthorised purchase can complicate repairs or void manufacturer support. The buyer obtains a watch and a story, but sometimes not the right to full aftercare.

Countermeasures are being developed, and technology offers some hope. Brands and third parties are experimenting with tamper-evident seals, micro-engraved serials, NFC chips, and blockchain-led provenance systems. In theory, a blockchain-backed digital passport ties an immutable record to a serial number — service history, ownership chain, and authenticity checks logged forever. In practice, adoption is patchy and standards are fragmented. NFC chips and laser-etched serials are helpful, but they hinge on universal adoption and robust verification at the point of service. Until there is widespread interoperability and industry-wide commitment, these tools are useful but not definitive. They make the life of a forger harder, but not impossible. The human factor — the willingness of a buyer to perform due diligence — remains the ultimate bulwark.

Community policing is one of the underrated strengths of the watch world. Trusted forums, private WhatsApp groups, and vetted Discord channels function as modern neighbourhood watches: reputations are communal currency, and word travels fast. Experienced buyers and moderators can often sniff out a scam before it spreads. But communities can also be tribal and punitive. Shame and mockery follow victims who report their losses, which dissuades disclosure and thus protects the predators. The healthier approach is the opposite: transparent reporting, preservation of evidence, and collective education. A community that treats victims with empathy turns experience into prevention. Publication of scam patterns, IP traces, and screenshot chains helps build the map of deception that keeps the next buyer safer.

Practical rules, given all of this, are surprisingly simple and stubbornly useful. Treat every high-value transaction as if it will be litigated. Document everything. Use traceable payments and avoid friends-and-family transfers for non-intimate trades. Ask for timestamped images and videos; insist on stamps and original paperwork; record conversations (with permission where required by law), and save every message. Prefer local transactions or escrow for international deals. Insure shipments to full value and require signature confirmation at delivery. When buying, verify the serial with the manufacturer’s service centres if possible. When selling, record the packing and handover process. If something feels like a puzzle with one piece missing — a vague reply, a dodgy invoice, a hesitant seller — walk away. There is always another watch.

Legal recourse is messy but real. Small claims courts, consumer protection agencies and, in some cases, criminal fraud charges can produce remedies when documentation is tight. A well-documented case — bank records, chat transcripts, time-stamped photos, courier tracking — is not just evidence; it’s deterrence. Often, a simple, clearly worded threat of legal action is enough to secure cooperation. But don’t pretend litigation is a hobby: it consumes time, patience and money. Sometimes prevention is the higher return.

There are also redeeming stories. Not every online transaction is a trick. For every scam, countless genuine, generative trades happen daily: a young collector finding a first mechanical watch at a fraction of retail, a veteran seller downsizing and passing a beloved piece to a new guardian, a small independent brand reaching a global audience it could never have accessed otherwise. The internet has democratised collecting in profoundly good ways. Microbrands with integrity can flourish; enthusiasts can find niche rarities once trapped in distant markets; service advice and educational resources are abundant. The key is to balance that generosity with vigilance. Treat the net like a market square with abundant treasures but also pickpockets.

Finally, let me return to the metaphor that brings this all into focus. The internet is a jungle — verdant, overflowing with life, richly generous and occasionally brilliant. Predators live there, yes, but so do rare orchids and birds with impossible colours. Walking requires respect. Don’t romanticise danger, but don’t overreact either. A machete in your hand is useful, but knowing the paths matters more. Curiosity guided by scepticism is your compass. Diligence is your machete. Community is the rope that keeps you from falling into a pit. And empathy is the water you share with others who get cut by thorns.

But of course, the predators aren’t always the ones sitting behind burner accounts and fake names. Sometimes they’re the ones with blue ticks, tailored suits, and camera crews. They smile into ring lights, call every viewer “brother,” and hold watches up like trophies of financial literacy. The modern scam isn’t always theft; it’s persuasion disguised as expertise. The influencer economy has blurred the lines between recommendation and advertisement so thoroughly that even seasoned collectors can’t tell whether they’re being educated or sold to. Channels once dedicated to horological passion have become storefronts of ego, driven by affiliate links, sponsored segments, and watch flipping masquerading as “portfolio diversification.” It’s not that these personalities start maliciously—they start passionate. But passion, once monetised, often mutates. When the algorithm rewards hyperbole, every thumbnail becomes a masterclass in exaggeration. “You NEED this watch.” “Top 5 investments for 2025.” “Why this piece will 10x in value.” The subtext is never “love what you own.” It’s “buy what I’m selling.”

The grey market has learned to feed on this kind of emotional hunger. Once a backdoor trade for discontinued references and near-mint resales, it has now evolved into a billion-dollar ecosystem built on perception. Trust, ironically, is the main currency. Buyers trust resellers because they seem successful. They trust them because they have storefronts with neon lights, vault backgrounds, and confident tones. Yet many of these operations run on wafer-thin margins, borrowed stock, or watches they don’t even own until they’ve sold them—known as “selling on memo.” It works beautifully until it doesn’t. One liquidity crunch, one market correction, and the dominoes start to fall. We’ve seen it before: vaults empty overnight, websites vanish, and “trusted dealers” suddenly stop answering messages. The fragility of reputation is the quiet truth that few discuss. In a world that prizes appearance over substance, legitimacy can be rented—until the bill comes due.

There’s also a deeper psychology at work here, one that doesn’t flatter us as buyers. Most of us aren’t driven by trust but by desire. We don’t seek reassurance first; we seek validation. The more scarce a piece appears, the more our logical circuits short out. Watch brands and resellers alike understand this primal switch. That’s why “limited edition” doesn’t always mean limited, and why countdown timers exist on pre-owned websites. It’s the oldest psychological trick in retail—manufactured urgency—and it works because it makes us feel like insiders, not customers. We’re convinced we’re beating the crowd, when in reality, the crowd is the product. Every click, every “just checking availability” message, fuels the algorithm that tells sellers what we crave next. It’s not the jungle that hunts us—it’s the mirage.

And then there’s the counterfeit ecosystem. Once crude, now terrifyingly precise. Factories in Guangdong or Istanbul can replicate case geometry, laser-etch serial numbers, and even mimic the micro imperfections of vintage lume. Some are so convincing that even brand service centres have been fooled until they’ve taken apart the movement. These aren’t the old fake “Rolex” models with misaligned cyclops lenses and spelling errors—these are one-for-one clones built with legitimate ETA movements and custom dials that pass every casual inspection. Entire YouTube channels have formed around dissecting them, often blurring the line between education and promotion. The counterfeiters have realised something profound: the goal isn’t to fool everyone—it’s to fool enough. And in the online resale jungle, “enough” can mean thousands of unwitting buyers who will never know.

Authentication services have tried to fight back. Some offer blockchain tracking, tamper-proof cards, or digital certificates. But these, too, are only as strong as the weakest link. Fake authenticity cards now circulate as their own black-market niche. One particularly devious scam involves swapping a real, authenticated watch for a fake one after the authentication seal is broken, reselling the fake with the genuine paperwork. To the buyer, everything checks out. By the time they realise the deception, the seller has already changed usernames, platforms, and probably continents. The only real defence against such tactics isn’t technology—it’s vigilance.

The irony is that while scams have become more sophisticated, so have the justifications. People rationalise risk when they’re emotionally invested. They’ll convince themselves that a too-good-to-be-true deal isn’t a red flag but a lucky break. They’ll downplay inconsistencies in photographs or accept delays in replies because they want the watch to be real. Hope can be a powerful narcotic, and scammers rely on it. Every false promise feeds a little more denial, until the truth becomes unbearable. The psychological aftermath of being scammed isn’t just financial loss—it’s humiliation. Victims often retreat from the hobby entirely, ashamed that they, the “smart ones,” got caught. But intelligence doesn’t immunise against manipulation. If anything, intelligence can make you more susceptible, because clever people assume they’ll see through deceit. They forget that confidence and honesty don’t always share a postcode.

Even established platforms can’t escape these dynamics. Take eBay’s “Authenticity Guarantee.” It’s a clever concept and works well for mass-market pieces, but it’s still a process run by humans under time pressure. Mistakes happen. Authenticators can be overworked or undertrained, and counterfeiters study their routines like chess opponents. Some fakes are created specifically to pass through those systems. There’s a grim irony in that—the more secure the protocol, the more targeted it becomes. Chrono24’s escrow, while invaluable, has its limits too. It can hold funds, but it can’t hold integrity. Once a watch arrives, the clock starts ticking for dispute resolution, and scammers thrive in that window. Delay the response, feign confusion, overwhelm with politeness—it’s a script that’s been perfected. By the time the platform rules in your favour, the seller’s account may already be gone.

To sell a watch online today is equally nerve-wracking. The psychology flips. Now you’re the one exposed, the one who must trust that the buyer won’t claim “item not as described” or file a chargeback after receipt. The burden of proof becomes a performance: photographs of packaging, videos of boxing, timestamped handovers at the post office. Even when you’ve done everything right, one dishonest buyer can reverse the entire transaction. Payment processors often side with the claimant because platforms prioritise customer retention over fairness. The seller is collateral damage in the battle for user trust. That’s why veteran sellers speak of “transaction fatigue”—the exhaustion that comes from constantly defending your own honesty.

Some enthusiasts have turned to in-person transactions, which aren’t without their own perils. Public meetups carry the risk of theft, robbery, or worse. Stories abound of collectors being lured to parking lots or cafes, only to be ambushed. Even if you meet in daylight, even if you bring a friend, you’re still navigating uncertainty. The smarter approach is to use a neutral location—many banks, jewellers, or even police stations now allow watch exchanges under CCTV. It may sound paranoid, but paranoia is just realism in disguise. In a world where a steel sports watch can represent six months’ salary, crime has adapted accordingly. The target isn’t just the object—it’s the confidence of the person carrying it.

The question, then, is whether this constant suspicion is sustainable. Can a hobby built on passion and precision survive an environment defined by distrust? Perhaps that’s the truest cost of the digital era: not money, but meaning. The watch world once thrived on community—forums where members vouched for one another, meetups where trust was tangible. Today, anonymity has eroded that foundation. Reviews can be fabricated, accounts can be cloned, reputations can be manufactured. The result is a culture where even honesty must be proven, and sincerity feels like a risk. Maybe that’s the saddest evolution of all—that we now approach beauty with caution.

Yet, paradoxically, this danger has refined the few who remain. The seasoned collector today is part detective, part philosopher. They read listings like crime scenes, analysing lighting angles, bezel reflections, and serial alignment. They know that every detail tells a story and that truth hides in plain sight. They’ve developed instincts that border on intuition—an almost animal sense of when something doesn’t smell right. That, too, is a kind of evolution. The internet may have made us wary, but it has also made us wise. Caution isn’t cynicism; it’s a form of respect—for ourselves, our money, and the craft we admire.

Of course, none of this changes the fact that temptation will always exist. A new listing appears: rare, below market value, local. The heart races. You tell yourself you’ve learned from the stories. You’ll ask for more photos, request references, and insist on a video call. But emotion overrides process. You picture it on your wrist, feel the weight of the bargain, the thrill of the find. This is how it happens. Not through ignorance, but through desire. That’s why every scam, no matter how technical, is ultimately emotional warfare. The battlefield isn’t digital; it’s psychological. Scammers don’t exploit our stupidity—they exploit our hope.

So where does that leave us? Somewhere between vigilance and exhaustion, perhaps. Between passion and paranoia. The joy of collecting hasn’t vanished, but it’s been tempered by caution. And maybe that’s not entirely bad. After all, horology itself is a study of balance—of tension and release, precision and imperfection. The same applies to trust. Absolute faith in others is naive; absolute suspicion is corrosive. The answer lies somewhere in between, in that fragile middle ground where curiosity meets caution.

If there’s a silver lining, it’s this: every honest transaction, every truthful exchange, becomes an act of quiet rebellion against the chaos. Each time you buy or sell with integrity, you contribute to the small ecosystem of trust that still exists in the hobby. That’s worth protecting. Because the alternative—a marketplace driven purely by opportunism—leaves no room for the soul of collecting. Watches, at their core, are about time, and time without meaning is just measurement.

The internet will never be tamed. It will evolve, adapt, and find new ways to test us. But that’s not a reason to retreat—it’s a reason to become better navigators. Know the terrain. Map the patterns. Recognise that the friendliest smile can hide the sharpest teeth. We don’t need to live in fear, just awareness. The jungle isn’t going anywhere. But neither are we.

So yes, the predators are polite, charming, and very well-dressed—but so are some of the heroes. And maybe that’s the enduring truth of this strange digital wilderness: we survive not by avoiding it, but by learning to see it for what it is. The trick is to move through it with eyes open, heart guarded, and wrists—hopefully—still intact.

Just About Watches

Just About Watches