Now, it would be tempting to assume that Rolex’s enduring value lies purely in the mechanics of scarcity or brand dominance. But the truth is more nuanced, layered with decades of cultural conditioning and careful orchestration. Rolex doesn’t flood the market with product; it cultivates demand like a vintner nurtures grapes — patient, deliberate, and fully aware that the fewer bottles produced, the more desirable the taste becomes. It’s a philosophy that has kept their watches not just relevant but revered, even in times when markets crash and currencies wobble. In 2025, despite global inflation, political turbulence, and the uncertain health of many luxury sectors, Rolex continues to thrive. Its resale value remains stronger than almost any other luxury timepiece, outperforming brands that once seemed untouchable.

Collectors and investors today aren’t simply buying a watch — they’re buying trust. That’s the cornerstone of Rolex’s long-term appeal. For over a century, Rolex has embedded itself into global consciousness as a tangible form of security, something that holds its own even when other investments falter. That’s not an accident; that’s design. Whether it’s the Submariner, the GMT-Master II, or the perennial Datejust, these watches aren’t just symbols of craftsmanship — they’re practical instruments of wealth preservation. A decade ago, buying one was a statement. Today, it’s an investment strategy.

But let’s address the obvious question: is Rolex still a good investment in 2025, given how inflated some of the secondary market prices became in the post-pandemic boom? The answer is yes — but with a layer of realism. The pandemic years created an unsustainable frenzy. Prices soared, dealers sold waiting lists rather than watches, and the notion of owning a new stainless-steel sports Rolex became as mythical as winning the lottery. That frenzy inevitably cooled as supply chains stabilised and speculative investors redirected their energy elsewhere. Yet, remarkably, Rolex didn’t collapse under that correction. While lesser brands saw resale prices plummet, Rolex retained its footing — proving once again that genuine demand outlasts hype.

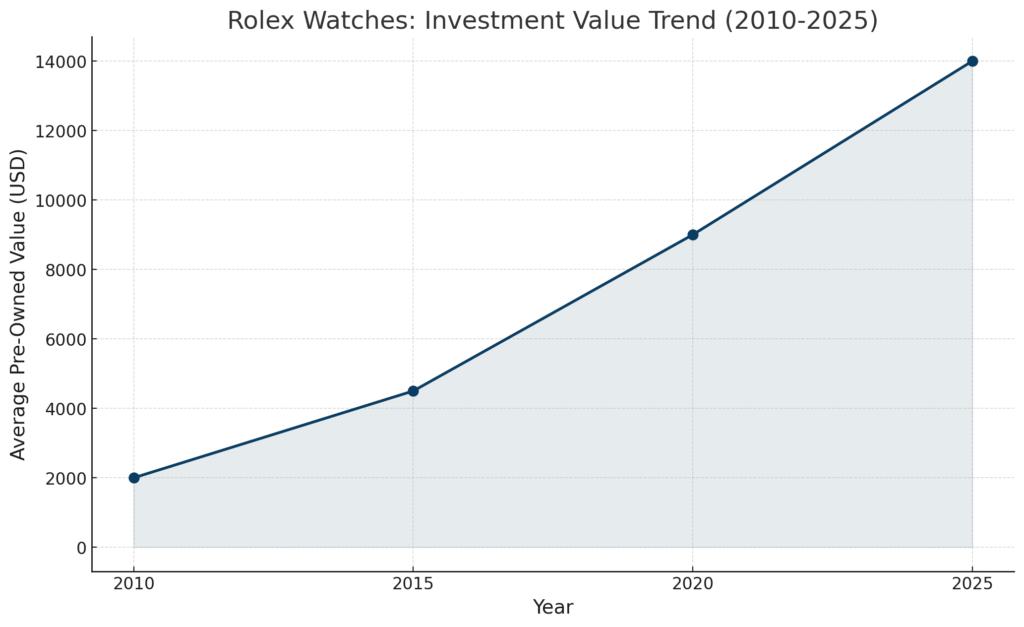

Today’s pre-owned market tells a fascinating story. Data from platforms that track tens of thousands of transactions show Rolex continuing to perform better than any other mainstream Swiss marque. Even models that saw slight declines in 2023 have largely stabilised or regained ground through 2024 and into 2025. It’s a brand that rarely suffers prolonged downturns; when it dips, it recovers quickly, and when it rises, it tends to stay elevated. The average appreciation rate over the last 15 years sits comfortably above 200%, with standout models — such as the Submariner, Daytona, and GMT-Master II — climbing by more than 500% over the same period. A Submariner that cost £1,500 in the early 1990s now trades hands at prices exceeding £10,000 for well-maintained examples, and even higher for specific references with original box and papers.

And yet, the psychology behind all this value retention is what fascinates me most. Rolex operates less like a watchmaker and more like a master conductor, orchestrating the emotional symphony of human desire. The scarcity we associate with the brand isn’t entirely natural; it’s curated. Rolex controls distribution with military precision, ensuring that demand perpetually exceeds supply without ever letting the tension break. There’s a waiting list for nearly every popular model — sometimes stretching from months into decades — and that’s exactly how they want it. You can’t buy exclusivity; you have to earn it, or at least wait long enough to feel like you have. And that waiting period, that silent anticipation, is part of the brand’s invisible value — it builds emotional equity.

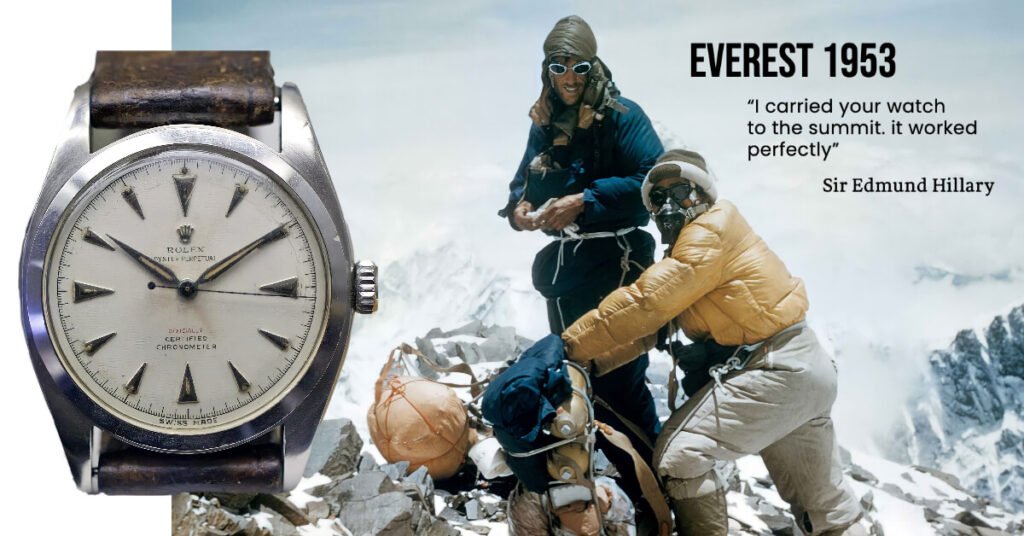

Collectors often tell themselves they’re immune to this manipulation, but let’s be honest — none of us truly are. Whether consciously or not, we’ve been trained to view Rolex ownership as a form of achievement, a punctuation mark in the story of success. It’s not simply about telling the time; it’s about telling others you’ve arrived. This isn’t cynical — it’s marketing genius woven into cultural evolution. From the wrists of mountaineers conquering Everest to astronauts exploring the unknown, Rolex has been strategically present at humanity’s defining moments. That kind of association builds mythology, and mythology sells — always has, always will.

What’s particularly interesting about 2025 is the generational shift underway. The new wave of buyers — primarily Gen Z and younger millennials — aren’t necessarily drawn to Rolex because their fathers or grandfathers owned one. They’re drawn because Rolex has transcended into something more universal: a currency of credibility. A recent survey suggested that 40% of men aged 18 to 34 see luxury goods like watches as legitimate financial assets rather than indulgences. This is a profound change in mindset. The same demographic that once prioritised digital convenience now embraces mechanical craftsmanship as an antidote to impermanence. Rolex sits perfectly at that intersection between heritage and modern aspiration. It’s both old-world and future-proof, a contradiction that younger buyers find irresistibly romantic.

The numbers tell their own story. Over the past decade, some models have appreciated beyond what even seasoned investors predicted. The Rolex Daytona remains the king of appreciation, with certain vintage “Paul Newman” references commanding six or even seven figures at auction. Meanwhile, modern iterations such as the ceramic-bezel Daytona 116500LN still command secondary prices several times higher than retail. Similarly, the Submariner — particularly the “Hulk” and “Kermit” models — continue to see sustained demand. The GMT-Master II “Batman” and “Pepsi” are no less iconic, maintaining their grip on waiting lists and resale charts alike. These aren’t isolated cases; they’re part of a pattern rooted in controlled scarcity and consistent global desirability.

Of course, investing in a Rolex doesn’t always mean buying new. In fact, for many serious collectors, the real opportunity lies in the pre-owned market. Purchasing a pre-owned Rolex often means bypassing the initial depreciation that occurs the moment a watch leaves the authorised dealer’s counter — assuming you can even get one at retail in the first place. By entering the secondary market, buyers can capitalise on watches whose values have already stabilised, ensuring that future growth is more predictable. Naturally, this approach requires experience — or at least good guidance — because authentication and condition are everything. Documentation, original boxes, and unpolished cases can make the difference between a watch worth £8,000 and one worth £12,000.

What many new investors overlook is that Rolex, unlike volatile asset classes, doesn’t operate on the same speculative wavelength. A watch isn’t a stock that can lose half its value overnight. Even in downturns, Rolex prices move with a kind of gentle elasticity. They may contract slightly, but they never collapse. That’s partly because Rolex owners themselves act as stabilisers in the market. The majority don’t panic sell; they hold — sometimes for decades — because they trust the brand’s long-term trajectory. It’s not just the product that’s durable, but the confidence it inspires.

This confidence, however, must also be understood in context. Rolex’s performance isn’t merely the result of public sentiment; it’s the product of meticulous business control. The company remains privately owned, independent, and famously secretive about its production volumes. Most estimates place annual output around a million units, but this figure has never been officially confirmed. That mystery adds another layer of allure. Unlike conglomerate-owned competitors, Rolex isn’t accountable to shareholders chasing quarterly profits. Its strategy unfolds over generations, not fiscal years. That’s why you never see Rolex chasing trends — it defines them, quietly and methodically.

Comparing Rolex to other luxury watch brands reveals an intriguing hierarchy. Patek Philippe may hold the crown in haute horology and artistic movement finishing, and Audemars Piguet commands immense prestige in design-led circles with its Royal Oak. But in terms of universal recognition, resale reliability, and sheer liquidity, Rolex stands alone. It is the watch world’s equivalent of blue-chip stock — stable, recognisable, and instantly tradable anywhere in the world. While you might have to educate someone about the finer points of a Vacheron Constantin or a Breguet, you never have to explain a Rolex. That ubiquity is part of its financial armour.

Still, as with any investment, caution and awareness matter. Not every Rolex model is destined to appreciate. Some references, especially those with more polarising designs or precious metal variants, can lag in resale strength. The trick is to focus on the core — the timeless sports models, the ones with stories attached. Pieces like the Explorer, linked forever to Tenzing Norgay and Sir Edmund Hillary, or the Milgauss, built for scientists working near electromagnetic fields, carry enduring narratives that transcend fashion. These stories are what collectors buy as much as the watches themselves. When emotion and heritage intertwine with engineering, you get an investment that resists obsolescence.

Another dimension worth mentioning is Rolex’s cultural insulation against volatility. In times of economic uncertainty, when stocks falter or crypto collapses, physical assets like luxury watches tend to thrive. They serve as safe harbours for capital — tangible, transportable, and immune to digital instability. For that reason, we’ve seen an uptick in traditional investors diversifying into watches. In their eyes, a Rolex isn’t just jewellery; it’s a hedge, a form of wealth preservation that’s as beautiful as it is practical.

There’s also an emotional element to this kind of investment that shouldn’t be underestimated. A Rolex can be worn daily, admired, and handed down — it participates in life rather than sitting passively in a vault. That human connection adds intangible value, one that can’t be measured in percentages or resale graphs. When someone buys a Rolex, they’re often buying into continuity — a link between generations, achievements, and aspirations. Try finding that in a stock certificate.

The digital era has further amplified Rolex’s presence in ways even the brand itself may not have fully anticipated. Social media has turned these watches into global icons of success and taste. Every close-up wrist shot or “unboxing” video fuels desire among audiences who might never have considered mechanical watches before. Rolex has benefitted from this digital ecosystem without ever needing to chase it. The brand barely advertises compared to competitors, yet its visibility remains unmatched. That’s the ultimate paradox — Rolex doesn’t shout; it whispers, and the world listens.

It’s also worth acknowledging that the pre-owned ecosystem in 2025 is far more sophisticated than it was even a few years ago. Online platforms now provide verified authentication, price tracking, and transparent histories, reducing many of the traditional risks associated with second-hand buying. As a result, accessibility has improved without diminishing prestige. More people than ever are entering the market, fuelling liquidity and ensuring that Rolex values remain supported by real demand rather than speculative froth.

If there’s a lesson to be learned from all this, it’s that Rolex’s investment value is less about chasing quick profit and more about understanding endurance. Buying one should never be treated like flipping cryptocurrency or chasing the next hype sneaker. It’s a slow burn — a measured commitment to an object that will likely outlast you. Those who approach it with patience and curiosity tend to reap the greatest rewards. In the UK and across Europe, we continue to see a consistent appetite for both new and pre-owned Rolexes despite broader financial pressures. When everything else seems uncertain, people gravitate towards certainty — and few things in the luxury world provide that quite like a Rolex.

To answer the question plainly: yes, certainly if you were to look at the Chrono24s of the world. Rolex remains a good investment in 2025 — perhaps even more so than in previous years, because the frenzy has cooled into something healthier, more sustainable. Prices are no longer driven solely by hype; they’re supported by a genuine, informed collector base. Buyers are smarter, platforms are safer, and the brand’s mystique has only deepened. The notion that Rolex could ever become “just another luxury brand” seems almost laughable when considering its reach, reputation, and resilience.

Ultimately, whether you’re buying for profit, pleasure, or legacy, a Rolex has a way of justifying itself. It sits at the intersection of art, engineering, and identity — a rare place where mechanical precision meets emotional meaning. That’s why, even after all these years and all these market fluctuations, the conversation never really changes. The numbers might shift, the trends may come and go, but the question remains eternal — and the answer, at least for now, remains the same: yes, Rolex is still worth it. It always was.

Part of what makes investing in Rolex watches in 2025 so compelling is that the value of these timepieces is built not just on scarcity or demand but on human behaviour itself. The waiting list, often derided by outsiders as bureaucracy or absurdity, is, in reality, a masterclass in psychological engineering. I’ve met buyers who have waited over a decade for a Daytona, and in that time, their desire for the watch didn’t fade — it intensified. That’s because Rolex has cleverly positioned waiting as a form of narrative. Every year spent anticipating a call from an authorised dealer becomes part of the story. When the watch finally arrives, it’s not merely a transaction; it’s the culmination of years of patience, longing, and expectation. That narrative, once complete, becomes part of the emotional value embedded in the watch. It’s why even pre-owned examples of the same model can command prices that exceed retail — because they inherit that story without the wait.

Then there’s the cultural resonance of Rolex, which continues to underpin its investment potential. Unlike other luxury goods, Rolex has embedded itself in global consciousness as a marker of accomplishment and reliability. When a Submariner or Explorer appears on someone’s wrist, it doesn’t just signify wealth — it signals taste, awareness, and the subtle mastery of timing, both literal and metaphorical.

In a world obsessed with instant gratification, a Rolex represents an earned victory, a tangible acknowledgement that life’s milestones have been reached through persistence and care. That cultural currency is difficult to quantify, yet it directly translates into financial value. Every generation of buyers, from the classic collectors to younger enthusiasts in 2025, perceives Rolex as more than a watch; they perceive it as a statement of personal narrative, social position, and longevity.

The secondary market has evolved dramatically over the past decade, becoming almost a self-contained ecosystem that supports and reinforces Rolex’s status as an investment. Whereas once a dealer’s word and reputation dictated prices, digital platforms now track transactions globally, allowing for real-time market intelligence. This transparency has democratized access, enabling informed decisions about which references are likely to appreciate and which might plateau. It’s fascinating to observe how Gen Z buyers, in particular, are navigating this ecosystem. They’re analytical, data-driven, and aware of historical trends in a way previous generations often weren’t. For them, Rolex is a hybrid investment — part tangible asset, part cultural signal, and part digital-savvy portfolio play.

Investing in new versus pre-owned Rolex watches remains a nuanced decision. New watches offer the thrill of immediacy and the assurance of factory condition, yet they often come with premiums due to their scarcity. Pre-owned models, conversely, allow investors to bypass the initial depreciation while providing access to watches that have already demonstrated historical appreciation. However, purchasing second-hand demands careful attention to condition, authenticity, and provenance. Every scratch, service record, and original document can influence the long-term investment value. Savvy buyers in 2025 understand that these nuances can be the difference between a watch that grows steadily in value and one that stagnates.

The enduring allure of Rolex in investment terms also lies in its remarkable resistance to economic fluctuations. Luxury assets often feel the brunt of recessions or crises, yet Rolex consistently demonstrates resilience. During periods of uncertainty, whether driven by geopolitical events or market turbulence, collectors tend to gravitate toward tangible, historically reliable assets. A Rolex, particularly a sought-after model like the Daytona, Submariner, or GMT-Master II, is a safe harbour in a volatile landscape. The very qualities that make it desirable as a watch — precision, robustness, and timeless design — also make it a steady performer as an investment. It’s a rare instance where emotional and financial confidence align.

What’s also striking is how Rolex’s design philosophy continues to reinforce investment stability. Unlike many competitors, Rolex evolves incrementally, refining its models over decades rather than chasing fleeting trends. This subtlety allows past, present, and future iterations of the same reference to feel part of a cohesive family, creating a sense of continuity that collectors crave. A Submariner from the 1960s looks at home alongside a model from 2025, yet the latter incorporates modern materials, improved movements, and subtle aesthetic updates. That balance between heritage and innovation ensures that all Rolex watches retain desirability, reinforcing their long-term value.

Rolex watches also carry symbolic weight as intergenerational objects. They are assets that can be passed down, creating a tangible link between one generation and the next. I’ve observed collectors who carefully document service histories, original packaging, and even stories associated with specific milestones in their lives, fully aware that this context amplifies value for future buyers. A vintage GMT-Master, for example, isn’t just a collector’s item; it’s a chronicle of exploration, work, and family achievement. This human dimension is unique among investment assets — few commodities allow for such rich storytelling without sacrificing liquidity or desirability.

In contrast to other luxury brands, Rolex’s investment profile remains unrivalled. Patek Philippe, Audemars Piguet, and Vacheron Constantin may offer extraordinary craftsmanship, but their accessibility and ubiquity do not match Rolex’s global recognition. Rolex’s widespread brand literacy ensures that its watches are instantly understood and valued in any market worldwide. Even in cities where buyers are novices to horology, Rolex retains near-universal recognition, allowing for liquidity that other luxury watches cannot always guarantee. This is a critical factor for investors who need the assurance of a market that can absorb and support value at virtually any time.

Finally, there’s the intrinsic satisfaction of ownership — an emotional and psychological dimension that cannot be overlooked. Unlike other assets, a Rolex is not inert; it’s alive on your wrist, a daily companion that merges utility with beauty. Each glance at the dial is a reminder of craftsmanship, history, and personal achievement. This emotional attachment reinforces rational investment decisions because owners are less likely to liquidate during downturns, preserving both the watch’s value and the integrity of the market. A Rolex, in this sense, is more than a financial instrument — it’s a living narrative, continuously appreciated both emotionally and monetarily.

So, in 2025, the answer remains emphatically positive. Rolex watches continue to represent one of the most reliable forms of investment in the luxury sector. They combine scarcity, craftsmanship, cultural symbolism, and liquidity in a way that few other assets can. For those who understand the market, approach purchases with knowledge and patience, and appreciate the deeper human value embedded in these timepieces, investing in Rolex offers not only the potential for financial gain but also a rare connection to legacy, storytelling, and achievement.

And from my perspective at Just About Watches, it’s never just about numbers. Each watch tells a story, captures a moment, and becomes a vessel for memory and identity. Watching collectors and investors navigate the market, sharing their experiences and passion, reminds me that Rolex is not merely a brand — it’s a community, a chronicle, and a marker of life itself. Whether you’re buying your first Submariner, finally acquiring a coveted Daytona, or exploring the pre-owned market for a rare GMT-Master, remember that the true investment lies as much in the experience as in the price. Treat it with care, respect the craft, and you’re not just purchasing a watch — you’re securing a legacy.

Just About Watches

Just About Watches